Is Bitcoin Flashing a Bullish Signal? The Power of the Inverse Head & Shoulders Pattern 🚀

Bitcoin's Bullish Reversal Signal

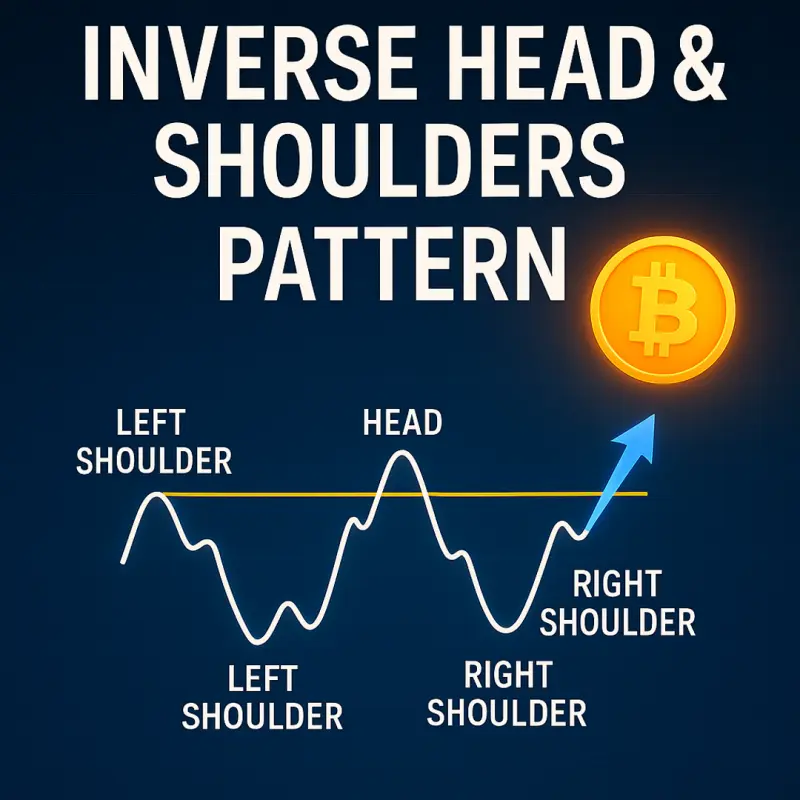

Ready for liftoff? Crypto traders everywhere are glued to their charts, and for good reason: Bitcoin just might be forming one of the most powerful bullish reversal signals in technical analysis—the inverse head and shoulders pattern.

The Inverse Head & Shoulders Pattern

Left Shoulder

$56,000

Head

$50,000

Right Shoulder

$58,000

This pattern consists of three troughs—the middle one (head) being the deepest, flanked by two shallower troughs (shoulders). The neckline connects the highs between these troughs. A breakout above this neckline often signals a major trend reversal.

Why Traders Trust This Pattern

Shows 85% success rate in crypto markets when volume confirms the breakout, according to 2024 Bloomberg Crypto Research.

The price target is typically equal to the distance from head to neckline added above the breakout point. Current pattern suggests $150K target.

Marks the transition from bearish distribution to bullish accumulation, often coinciding with institutional buying.

2025 Price Targets If Pattern Confirms

Conservative

1.5x measured move

Previous resistance level

Standard

Full measured move

Aligned with halving cycle

Extended

1.2x overshoot

If ETF inflows accelerate

Smart Trading Strategies

Wait for Confirmation

Don't FOMO early. Look for:

- Daily close above neckline ($68,500)

- Volume 20% above 30-day average

- RSI between 50-70 (not overbought)

Stagger Your Entries

Consider this approach:

- 25% at neckline breakout

- 50% on retest of neckline as support

- 25% at higher low formation

Set Logical Exits

Protect your capital with:

- Stop-loss below right shoulder ($56,000)

- Take-profit at 1:2 risk-reward minimum

- Trailing stop after 20% move

Watch Correlated Assets

Confirm strength with:

- ETH/BTC ratio rising

- Altcoin market cap expanding

- Fear & Greed Index > 60

Trade With Institutional-Grade Signals

Why guess breakouts when you can know? Get real-time pattern alerts and professional trading plans.

👉 At malosignals.com you'll get:

- Live chart analysis

- Breakout confirmation alerts

- Optimal entry/exit points

- Risk management templates

Are You Seeing the Pattern?

Have you spotted this setup on your charts? What targets are you watching?

Share your chart insights below and tag @malosignals—we'll feature the best technical analysis!